China keeps adding liquidity amid Evergrande risks - BNN Bloomberg

China’s central bank boosted its gross injection of short-term cash into the financial system after concern over a debt crisis at China Evergrande Group roiled global markets.

China’s central bank boosted its gross injection of short-term cash into the financial system after concern over a debt crisis at China Evergrande Group roiled global markets.

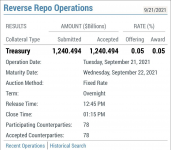

The People’s Bank of China pumped 120 billion yuan (US$18.6 billion) into the banking system through reverse repurchase agreements, resulting in a net injection of 90 billion yuan. That matches the amount seen on Friday, and was just below that of Saturday. Sentiment was also boosted after Evergrande’s onshore property unit said it plans to repay interest due Thursday on its local bonds.