Evergrande is due to pay $83.5 million interest on Sept. 23 for its March 2022 bond. It has another $47.5 million interest payment due on Sept. 29 for March 2024 notes. Both bonds would default if Evergrande fails to settle the interest within 30 days of the scheduled payment dates.

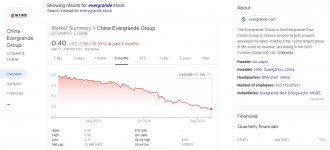

In any default scenario, Evergrande will need to restructure the bonds but analysts expect a low recovery ratio for investors. Trading of the company's bonds underscored just how dramatically investor expectations of its prospects have deteriorated this year.

The 8.25% March 2022 dollar bond was traded at 29.156 cents on Monday afternoon, yielding over 500%, compared to around 13.7% at the beginning of year. The 9.5% March 2024 bond was at 26.4 cents, yielding over 80%, compared to 14.6% at the start of 2021.

Goldman Sachs said last week that because Evergrande has dollar bonds issued by both the parent company and a special purpose vehicle, recoveries in a potential restructuring could differ between the two sets of bonds, and any potential restructuring process may be prolonged.